Nudged: A huge trial found using the social norm nudge was best at persuading people to pay back on time

Recent research in behavioural science has tried to identify effective strategies to positively influence the behaviour of specific social groups.

This could mean ensuring that more people attend regular check-ups and detect health conditions early, or are vaccinated against specific diseases, or pay their taxes on time.

In the context of consumer finance, these behaviourally motivated interventions could also encourage people to re-pay their loans on time.

This could be positive for both financial companies and their customers as it would help to reduce late payments on loans, while also improving people’s credit score and preventing them from racking up huge debts.

One promising intervention for reducing late payments and even defaults entails sending targeted text messages designed to positively influence people’s behaviour.

This is an appealing and desirable solution for many stakeholders, as sending text messages in bulk is both easy and affordable, given that most financial organisations already send regular texts to their customers and thus have the necessary infrastructure in place.

Recent studies testing the effectiveness of text-based interventions to help people who are falling behind on their loan repayments used messages that appealed to different types of motivations. For example, some messages highlighted socially acceptable behaviours, while others appealed to people’s inherent morality and conscience.

To shed some light on what message content maximises the effects of these interventions, my research team - which included Juan-Camilo Cardenas and Nicolás de Roux, of Universidad de los Andes - carried out a large-scale study in collaboration with one of the biggest banks in Colombia.

Our hope was to understand what behaviorally motivated messages were more likely to inspire different sub-groups of customers to re-pay their loans, which could help financial institutions design more effective interventions.

What text messages affect the behaviour of borrowers?

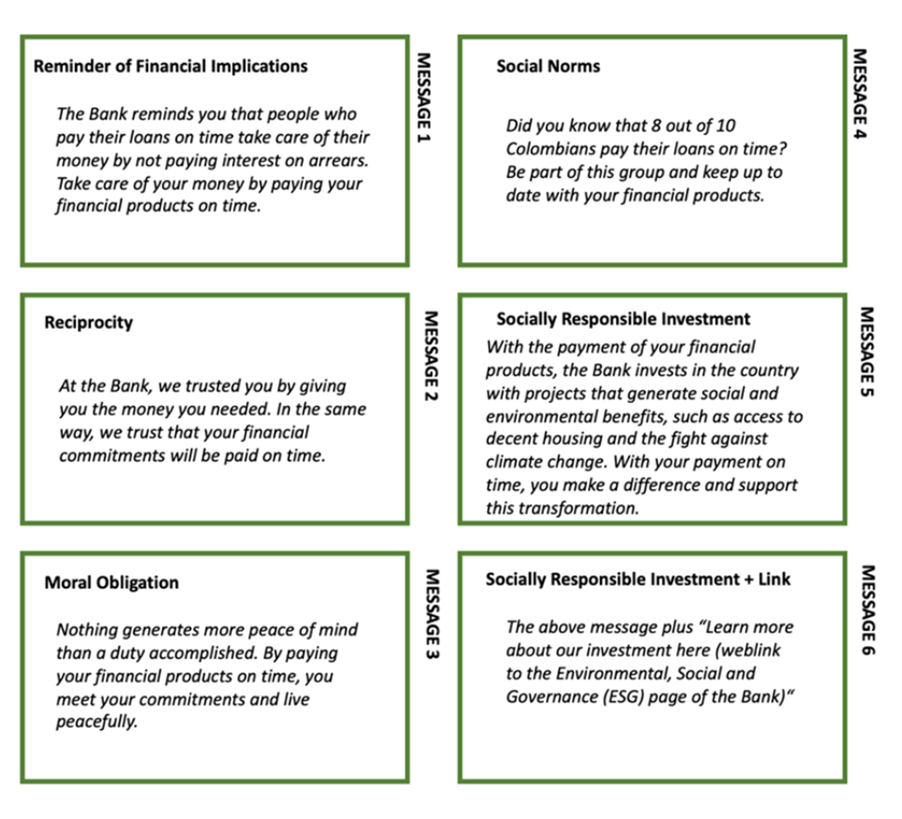

As part of our study, we wrote six different messages (see them below) that appealed to different motivations for re-paying bank loans on time. These motivations included a reminder of the financial implications, reciprocity, moral obligation, social norms, and socially responsible investing with a link to learn more about the bank’s Environmental, Social and Governance (ESG) practices.

The large Colombian bank we collaborated with sent one of these six messages to six groups of borrowers every week for three consecutive months and sent no message to a seventh group. A total of 7,029 borrowers was enrolled in the first trial of the study, all of which were late with their mortgage or credit card payments.

Subsequently, we conducted a second trial, where we sent the same six messages to 8,040 additional borrowers who were 'non-delinquent' (ie, were on time with their re-payments). This allowed us to test whether different types of messages also encouraged borrowers who weren’t struggling to meet their payment deadlines to continue re-paying their loans on time.

Social norms nudge is best at stopping late loan payments

To evaluate the effectiveness of the six messages we measured the probability that borrowers in the different groups would re-pay their loans every week. We then analysed these results using statistical methods and machine learning algorithms.

Remarkably, we found that receiving any of the six behavioural messages decreased the probability that borrowers behind with their payments would continue to be late with by four per cent.

When the messages were sent to bank customers who were on time with their payments, however, they did not reduce the probability that they would be late with future payments. This suggests that text-based interventions are most suited for borrowers who are late with their payments, rather than as a preventative measure encouraging people to continue re-paying their loans on time.

The message related to social norms (ie, suggesting that most people pay their loans on time and encouraging customers to do the same) was the most effective. In fact, customers who were late with their loan payments and received the social norms-related message were almost seven per cent less likely to miss their next payment.

Better results for wealthier customers

The large Colombian bank we worked with also held key financial and administrative data for each of their borrowers. This allowed us to assess the effects of different types of text messages on the behaviour of borrowers from different socioeconomic backgrounds.

Notably, we found that the borrowers who benefited most from the intervention, were men, had a larger monthly income, a better education, a job, and higher credit scores, and were less indebted overall. Essentially, customers with a higher socioeconomic status who were late with their loan re-payments were more likely to send a payment to the bank after receiving a text message than delinquent borrowers with a low socioeconomic status.

We observed that wealthier customers responded more to related messages outlining their moral obligation – one potential interpretation is that these messages may have appealed to their inherent sense of ‘right’ and ‘wrong’ – while customers with a lower socioeconomic status responded more to financial contract reminders or social norms-related messages.

Our findings also suggest that delinquent borrowers who took unsecured loans from the bank, such as people with credit card debt or consumption loans, are more likely to positively change their behaviour after receiving behavioural text messages than people with secured loans, such as mortgages.

How to design effective messages for different borrowers

We conducted one of the most comprehensive studies so far exploring the effects of carefully designed text messages on loan delinquency rates. Our work offers valuable insight that could inform the creation of successful interventions tailored for different types of customers.

Overall, we found that while most texts could help financial institutions to reduce late loan payments, different borrowers may be more responsive to different types of messages. Firstly, these interventions seem to work with borrowers who are late with their payments, but not borrowers who typically re-pay their loans on time.

In addition, banks and financial institutions might want to send different messages to wealthier and less financially stable borrowers. Individuals with a higher socioeconomic status appear to respond best to messages appealing to their inherent morality, while people with a low socioeconomic status are more motivated by messages related to social norms or reminding them of the financial implications of not re-paying their loans.

Finally, for financial organisations that are unable to deliver customised messages or prefer to send the same message to all borrowers irrespective of their socioeconomic status, text messages appealing to social norms might be the best solution, as we found that they are on average the most effective in reducing loan delinquency.

Further reading:

Barboni, G, Cárdenas, J C, and de Roux, N (2022). “Behavioral Messages and Debt Repayment”, Documento CEDE 2022-22.

Giorgia Barboni is Assistant Professor of Finance and teaches Corporate Finance on MSc Finance plus Foundations of Finance on the Undergraduate programme.

For more articles on Finance and Markets sign up to Core Insights here.

X

X Facebook

Facebook LinkedIn

LinkedIn YouTube

YouTube Instagram

Instagram Tiktok

Tiktok