Arms race: Investment managers who embrace AI will replace those that do not

Artificial intelligence will form a material part of the future of modern service industries.

The more expensive the service, the more knowledge recall, planning and meticulous execution of the task, and the lower the need to interact with stakeholders, the greater the potential for automation.

This almost perfectly describes many key investment management functions.

While artificial intelligence (AI) may not fully replace investment managers in the near future, investment managers that harness AI will certainly replace those that fail to do so.

Most service industries need to catch up and investment management is no different. Industry structures that previously created stability now present blocks to evolution as change becomes inevitable. The key problem though is the huge gap in AI knowledge and skills across the industry.

Given AI’s rapid rise this is understandable. However, the cost will be felt by pension fund allocators through the blocking of new opportunities to potentially make better returns and cost savings, while increasing the risk of exposure to service providers that mis-deploy these new technologies.

Why invest managers must upskill

AI’s economic impact will come in the form of another wave of industrial automation that started with the mechanisations of the industrial revolution in 1700s England. This time, though, it is focused on the automation of intelligence, which will feel its biggest impact in services, the largest part of the UK economy.

For professionals dealing with these significant changes, the first step is to accept we are all now involved in the technology arms race around AI; the next step is to acquire the skills and the vision to harness it.

Why should pension fund allocators care?

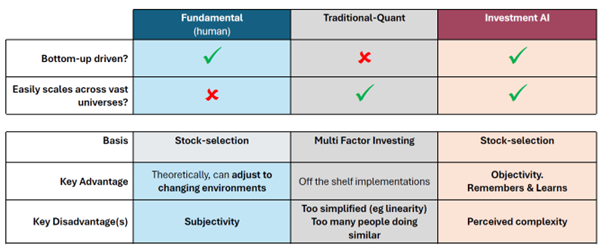

Current options for actively managed strategies in fixed income and equities are generally either fundamental, or quant.

Fundamental strategies in the equities space use teams of analysts to meet companies' management and form a qualitative view on the prospects of a company or an investment. They can add value from the bottom-up, which is a good thing as these returns tend to be less well correlated to the markets, but they have the inherent weakness that they are not scalable across large universes of securities, needing to use screening tools to do much of the heavy lifting.

Traditional quants are the opposite. They tend to be inherently top-down, a disadvantage that tends to make them more similar to inexpensive factor tilted exchange-traded funds. However, they are scalable across large investment universes.

An AI alternative can potentially combine the advantages of these approaches and leave behind the inherent disadvantages; systematically selecting stocks by replicating much of what a fundamental analyst does, but scaling this up to cover a huge number of companies very quickly. The results are impressive if you know how to develop the technology.

LLMs are the future, not the present

The misapplication of AI is a significant risk to the industry due to a shortage of skills and experience.

One emerging mistake is using black-box AI approaches, which lack transparency. Another is the overambitious use of generative AI in the form of current large language models (LLMs).

Machine learning models must be interpretable to ensure transparency and regulatory compliance. There are two traditional solutions: to use interpretable AI, or explainable AI.

Interpretable AI uses simpler models that can be directly understood, while explainable AI (XAI) uses complex models and attempts to explain them. Although XAI holds future potential, current best practices emphasise using interpretable AI to harness machine learning's power safely.

Currently, well-integrated LLMs can create significant efficiencies and hint at vast potential. The most exciting development is the emergence of AI agents. These agents, some powered by LLMs, will manage tasks such as financial planning, scheduling, data analysis, complex programming tasks, potentially automating processes.

The main problem is LLM’s are far from business ready for the majority of functions in investment management, although the potential is there.

In future generations, LLM technology, especially through AI agents, will become indispensable for investment management, but great care needs to be taken not to exceed the capabilities of such approaches in the near term.

Dangers of the technology skills gap

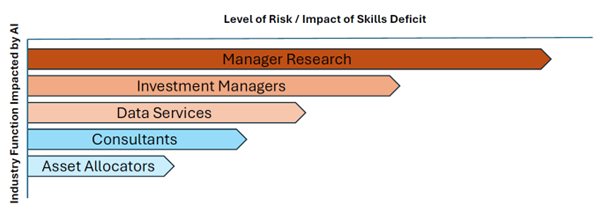

There are great opportunities for using AI technologies, but the present is more about risk and opportunity costs for pension funds.

If we consider this by taking the major functions in pensions and investments in which a skills deficit to AI will be most damaging to fiduciary duties, manager research and investment management functions present the greatest risks.

Manager researchers are gatekeepers with the power to approve or reject investment managers and strategies. Such groups are under great pressure in any case. An AI skills deficit would have two potential impacts.

First, it would prevent pension funds’ access to investment managers and strategies with potentially superior return characteristics. Second, it risks not identifying major flaws in the implementation of AI by incumbent managers.

A skills deficit in investment managers also presents a significant risk owing to the pressure to implement AI despite the a serious skills shortage. It risks the misapplication of AI in applying investment processes, a frightening prospect.

The integration of AI into investment management is inevitable and transformative. However, the journey towards fully leveraging AI's potential is fraught with challenges. Industry players must address the significant skills gap and approach AI adoption with both caution and strategic foresight.

Only those who effectively integrate AI - while maintaining a critical eye on its limitations and risks - will thrive in this evolving landscape.

As AI continues to evolve, its impact on pensions and investments will depend not just on technological advancements, but on the industry's ability to adapt and evolve alongside it.

This article was originally published by the Local Government Chronicle.

Further reading:

What does a digital pound mean for commercial banks?

How stablecoins will impact foreign exchange markets

Preparing for the AI revolution in real estate

Can stablecoins take on the US card giants?

Dan Philps is co-leader of AI research at the Gillmore Centre for Financial Technology at Warwick Business School. Learn more about the new MSc Financial Technology developed by the Centre.

Discover more about Finance and Markets by subscribing to our free Core Insights newsletter.

X

X Facebook

Facebook LinkedIn

LinkedIn YouTube

YouTube Instagram

Instagram Tiktok

Tiktok