End of the pipeline: The Russian invasion of Ukraine may be a 'final bonanza' for the gas industry

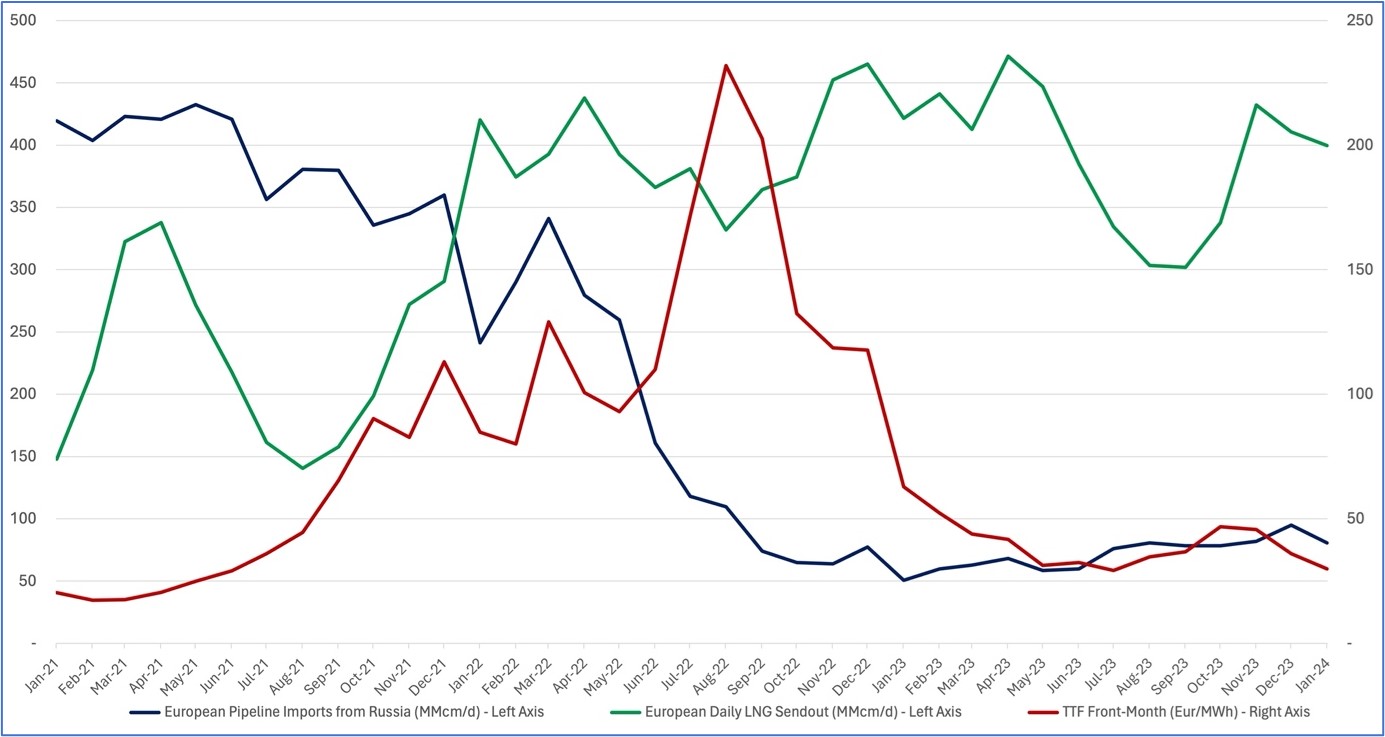

If a picture paints a thousand words, the graph below provides a concise summary of the impact of the Russian invasion of Ukraine on European gas security.

The blue line shows the flow of Russian pipeline gas to Europe. This was falling well before Russia invaded the Ukraine in February 2022.

Gazprom withdrew from European spot markets and declined to fill the storage that it owned in Autumn 2021, leaving Europe exposed to market volatility.

After the invasion changed Gazprom's trading terms to demand payment in roubles, Poland’s refusal to do so effectively closed the Yamal pipeline.

How did the Russian invasion affect gas prices?

This was compounded by the German Government’s decision to freeze the certification for Nordstream 2, followed by a series of subsea explosions that damaged both Nordstream pipelines, putting them out of operation for the foreseeable future.

As a result, Russian pipeline flows to Europe fell by 80 per cent. The impact of this is clear from the red line, which shows the Title Transfer Facility (TTF) gas price determined by a virtual trading point in the Netherlands. This serves as a benchmark for European gas prices.

The curve shows the panic that set in as Russian gas flows fell through the summer of 2022 and European traders looked to alternative sources of supply – principally seabourne Liquefied Natural Gas (LNG) – to fill Europe’s storage for the coming winter.

In late August, TTF hit a record level of €343 per megawatt hour. This compares to around €27 per megawatt hour two years earlier in 2020.

Why did demand for gas fall during the war in Ukraine?

After this period of madness, the market worked to drive down gas demand and attract significant volumes of LNG to European terminals.

Policy action also played its part. The EU lead the way with its REPowerEU programme and a range of interventions to reduce gas demand.

Demand fell as a result of both energy efficiency and demand destruction, the latter hitting energy intensive industries hard.

European think tank Bruegel’s demand tracker shows that EU gas demand fell 12 per cent in 2022, compared to the previous three years, and estimates that it was 19 per cent lower again during 2023. According to the International Energy Agency (IEA), gas demand in 2023 fell to its lowest level since 1995.

Governments also sought to cushion the record energy costs for consumers, allocating an estimated $651 billion for that purpose by June 2023.

The UK was particularly hard hit, despite producing half of the gas that it consumes, because of its dependence on gas for heating households and power generation.

The harsh lesson for all EU member states and European governments is that gas prices are beyond their control, set by international competition. The only way to secure more gas is to pay the highest price.

How has the global gas market changed?

The global gas market is very different from the oil market. According to the Energy Institute’s Statistical Review of World Energy, only 22.6 per cent of global gas production was traded in 2022. The vast majority was consumed where it was produced.

Europe played a largely passive role in the global LNG market, with cargos arriving only after Asian demand had been satisfied. The crisis changed that for good, aided by the fact that LNG demand in Asia was depressed by sluggish economic growth.

During the summer of 2022, Europe engaged in a bidding war to attract the LNG it needed, exporting its energy insecurity to less well-off importers such as Pakistan and Bangladesh.

To facilitate this trade, Europe has increased its import capacity. The German Government has covered the cost of five floating storage ships and three permanent import terminals.

Whether all this new capacity will be needed longer-term is a matter of some controversy.

The last few months have not been plain sailing for the LNG industry. Water levels in the Panama Canal have restricted traffic to Asia and attacks by Houthi rebels in the Red Sea have diverted Gulf cargoes around Africa, despite the greater time and cost involved.

In late January, the US Biden administration also paused a new LNG project while the Department of Energy reviewed the approval process.

This provoked an angry reaction from US Republican politicians and the gas industry. It has also caused some concern in Europe and Asia as the US was the world’s largest producer of natural gas and exporter of LNG in 2023 (followed by Russia and Qatar).

What is the future for gas in the green transition?

It does not threaten current expansion plans in the US, but the pause has led to a debate about the future role of LNG in the energy transition.

For Europe – by far the most important market for those US exports – the plan is to accelerate renewable energy and improve efficiency to lower gas demand faster and stop all Russian gas imports by 2027.

Reflecting on all this, what lessons can be learned?

Europe has been incredibly fortunate to have avoided a major shortage of natural gas.

A number of factors have acted in Europe’s favour. These include two relatively mild winters; reduced gas demand in Asia; the availability of sufficient infrastructure for importing and storing natural gas; and a well-functioning global LNG market that brought about a significant rebalancing of global gas flows in a short period of time.

In short, states and markets have worked together to pivot away from Russian pipeline gas.

As for the future, the availability of LNG remains tight and significant new supplies will not be available in time for the winter (after which, new supplies should balance the market).

Prices have already fallen, but they are still above long-run pre-crisis levels. The market remains unbalanced and price spikes are a possibility.

In this context, the war in Ukraine could have a broader impact on the future role of natural gas in the energy transition.

Europe has already decided that gas is part of the problem rather than the solution.

Elsewhere, countries that are not currently major importers of LNG may think twice about doing so. Those that are may reconsider their options.

There is significant uncertainty about the role of natural gas in the transition to net-zero, as reflected in the IEA’s energy scenarios.

As a result, Europe’s gas crisis may turn out to be a final bonanza for the LNG industry.

Further reading:

How can the world reach net zero?

A new strategy for the UK to meet heat pump targets

Why firms need to start measuring Scope 3 emissions in their supply chains

WBS research helps to drive Microsoft sustainability campaign

Michael Bradshaw is Professor of Global Energy and a Fellow of the Royal Geographical Society. He teaches Managing in a New World and Managing Sustainable Energy Transitions on the Full-time MBA and Forecasting for Decision Makers on the suite of MSc Business courses.

Learn more about making your organisation withstand a rapidly-changing environment on the four-day Executive Education course Leading People Through Change and Disruption at WBS London at The Shard.

For more articles on Sustainability sign up to Core Insights.

X

X Facebook

Facebook LinkedIn

LinkedIn YouTube

YouTube Instagram

Instagram Tiktok

Tiktok